Form W-9 for Health Savings Accounts

Print Blank W-9 Form for 2023 for Free

Get FormHealth Savings Accounts (HSAs) have emerged as a beneficial tool for taxpayers to manage their healthcare costs. While establishing and maintaining an HSA, one might encounter the necessity to process a Form W-9. This article aims to elucidate the functions, rules, and procedures surrounding Form W-9 in relation to HSAs.

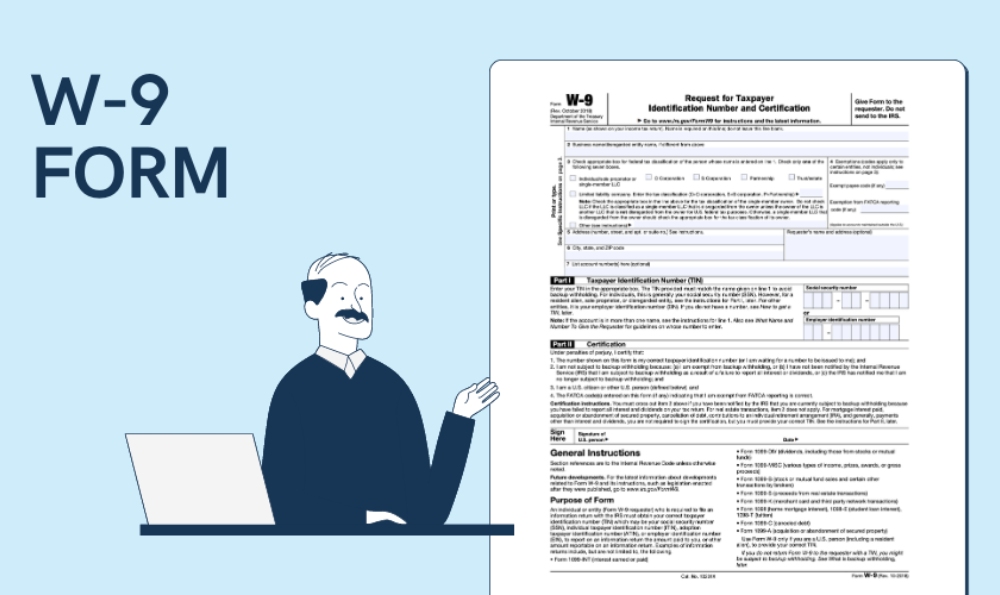

What is Form W-9?

Form W-9, as issued by the Internal Revenue Service (IRS), is primarily used by independent workers to provide employers with certain information. The form aids the collection of taxpayer identification numbers (TIN). The party requesting this document seeks to fulfill its IRS reporting obligations, such as submitting income paid to the recipient.

The Form W-9 and Health Savings Accounts Connection

Financial institutions often require account holders, including those of HSAs, to complete a Form W-9. The sample provides the institution with the necessary documents to report the contributions to and distributions from the account. Therefore, a Form W-9 becomes an integral part of the process of setting up an HSA account.

Importance of Accurate Information on Form W-9

It is imperative to provide accurate information on Form W-9, as it is a legally binding document. Any discrepancies found on the sample could lead to potential penalties. The information provided is also used to track contributions and withdrawals from the HSA, affecting the tax benefits you receive.

Key Components of Form W-9

- Name and Business Name: This should match the name on your income tax return.

- Federal Tax Classification: The IRS uses this to determine your tax status.

- Address and Account Numbers: Required information for the requester.

- Taxpayer Identification Number (TIN): For an individual, this is often their Social Security number.

- Certification: The signer certifies that the TIN and tax status they have given are correct.

Process of Filling Out Form W-9 for HSAs

First, download a copy of Form W-9 from the official IRS website. Complete the template carefully, ensuring all data lines up with your personal tax documents. Then, submit this copy to your financial institution to ensure they have your accurate tax reporting information.

Form W-9 plays a crucial role in managing Health Savings Accounts, ensuring the proper reporting of your contributions and distributions. Providing accurate information and understanding the importance of this document can maximize the tax benefits of your HSA and minimize any potential liabilities.

However, this guide should not replace professional advice. Always consult with a financial advisor or tax professional when dealing with tax-related matters or financial products such as HSAs.